Fossil Fuel not dead yet

Fossil Fuel not dead yet

“Old energy” will carry most of the load during the early years of the transition, as it guides “new energy” to the pinnacle of global power production.

Producing an electric vehicle (EV), for example, requires about twice as much energy as producing an internal combustion engine vehicle. That’s because EVs are essentially batteries on wheels… and batteries are basically just hunks of metal.

Mining and processing all of that metal demands a lot of energy.

To unearth enough raw ore to produce a single midsize EV battery, for example, mining operators must excavate about 250 tons of terrain. After that, they must transport roughly 50 tons of ore to various facilities around the world that can extract the targeted metals and then refine them to battery-grade standards.

With a few exceptions, every step of the process consumes some form of fossil fuel. Most other renewable technologies are even more energy-intensive than EVs.

Therefore, far from replacing fossil fuels, renewable energy technologies begin their productive lives by consuming more fossil fuel than legacy “dirty” technologies like internal combustion vehicles and natural gas-fired power plants.

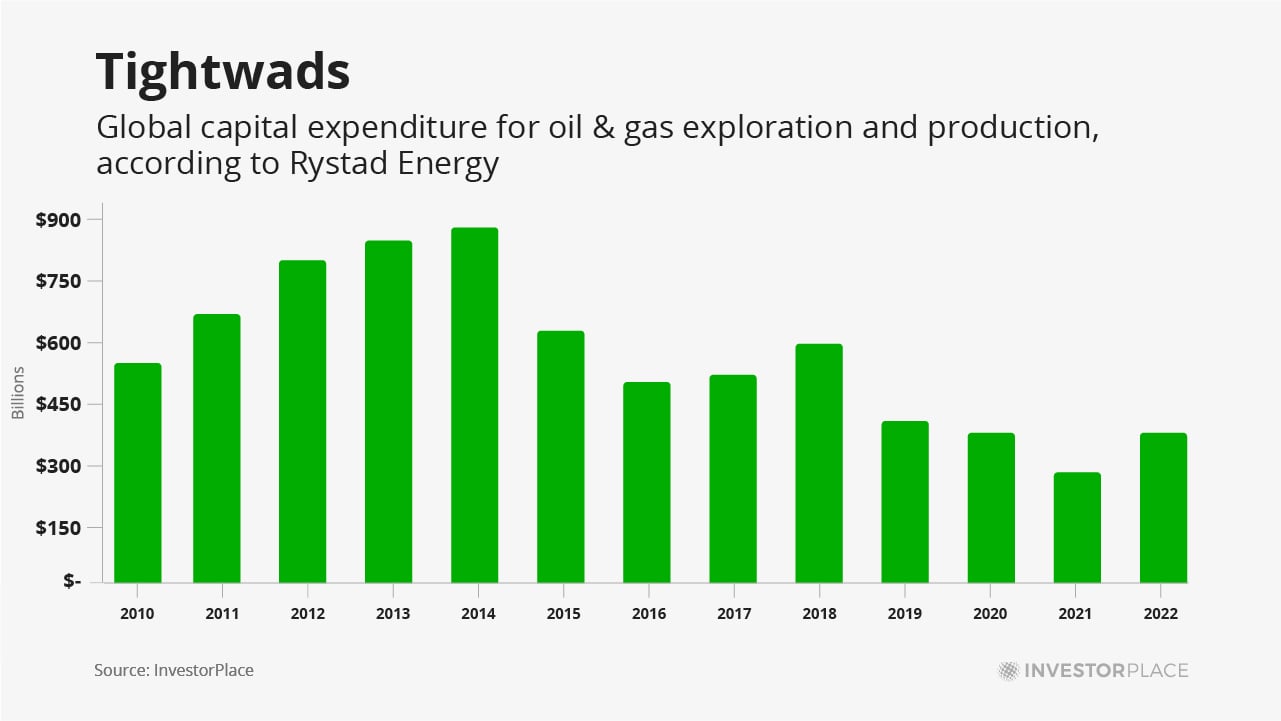

According to the International Energy Forum and IHS Markit, the world’s oil companies must invest $525 billion per year through 2030, just to keep pace with demand growth.

Instead, the world’s oil companies are spending about $500 billion less per year on exploration and production than they were in 2014.

To add perspective to these numbers, Rystad points out that for the first time ever, annual investment in oil and gas exploration last year fell behind global investment in renewable energy projects.

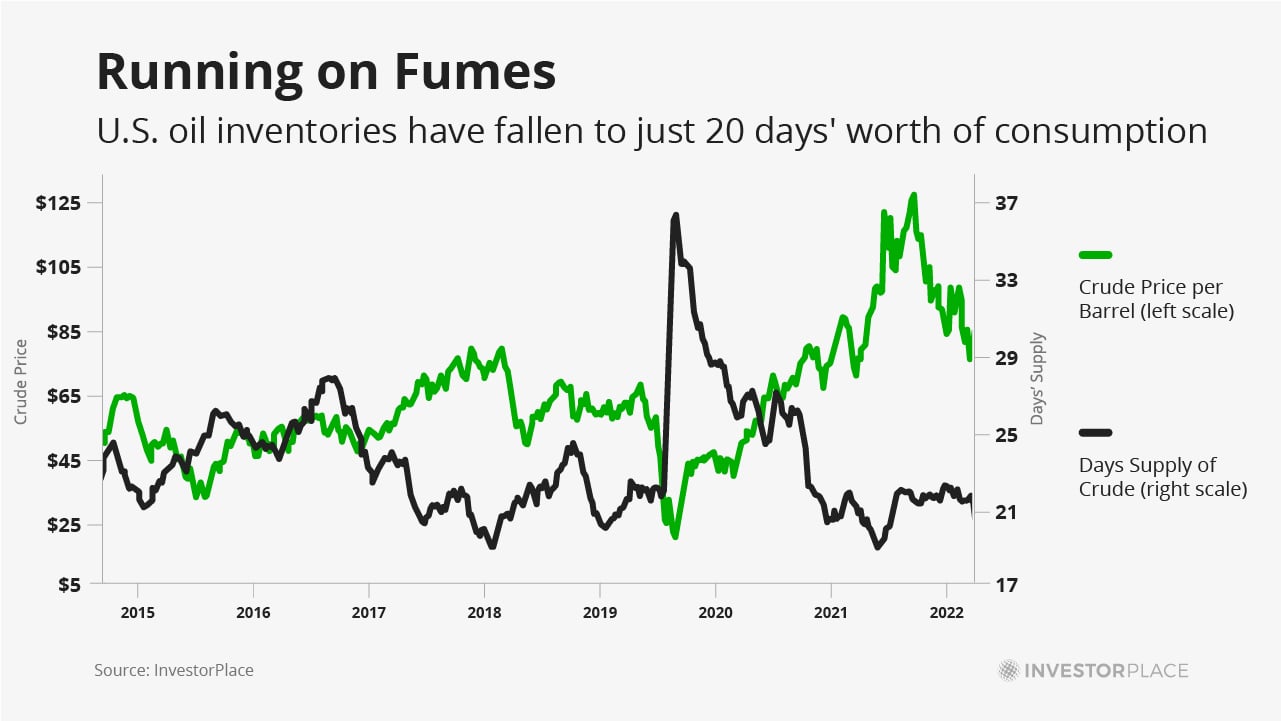

The chart below provides one insight into the current supply imbalance. It shows the level of U.S. crude oil inventories, expressed as “days’ worth” of domestic consumption. During the depths of the pandemic, this reading topped 33 days of consumption – the highest reading of the last three decades.

But recently, that reading dropped below 21 days, which is close to the lowest inventory levels of the last seven years. This low reading doesn’t mean the United States is running out of oil, but it does mean that demand growth is outpacing supply growth.

Bottom line: The global crude market features rising demand, coupled with uncertain supply. That’s a picture that should develop into rising oil prices.

Prices will move up due to underinvestment, use of fossil fuel to drive electric market and fossil supply limitations.

Comments

Post a Comment