#10. Gold Miners, Escape from Hyper Correlations

#10. Gold Miners, Escape from Hyper Correlations

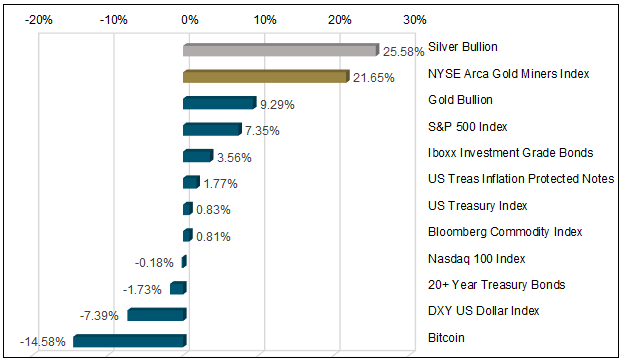

Gold miners had a very volatile year as well. Like gold and silver, the gold miners also had a downside overshoot due to severely poor market trading liquidity. All equities (not just gold equities) had a high level of intra-stock correlation due to the Fed tightening financial conditions (higher USD, higher real yields, lower liquidity). The 30-day rolling correlation between gold miners and the S&P 500 reached its highest level in 10 years, meaning broad market pricing flows dictated gold miners' price action, not fundamentals. Since the Fed signaled the aggressive portion of its interest rate hikes is over, there has been an unclenching of hyper-correlation across asset classes as fundamentals reassert themselves. Figure 7b is the Q4 2022 returns for various asset classes. It highlights the now diverging returns of the “better" asset classes (precious metals) that we believed were caught in the liquidity vortex versus fundamentally problematic asset classes.

Figure 7a. Gold Miners Index, Recovering Quickly from Undershoot (2013-2022)

Source: Bloomberg. Data as of 12/31/2022. Included for illustrative purposes only. Past performance is no guarantee of future results.

Figure 7b. Q4 2022 Returns Released from Hyper-Correlations

Source: Bloomberg. Data as of 12/31/2022. Included for illustrative purposes only. Past performance is no guarantee of future results.

Gold is a bell-weather asset class.

Comments

Post a Comment