#7. Energy Transition Metals Continue to Outperform

#7. Energy Transition Metals Continue to Outperform

Reality Check: Energy Transition Materials versus Other Commodities

From a macro and fundamental perspective, we believe the energy transition investment opportunity is promising, but how well have critical minerals performed on a relative basis? We created charts to provide a visual as to their relative performance against standard benchmarks.

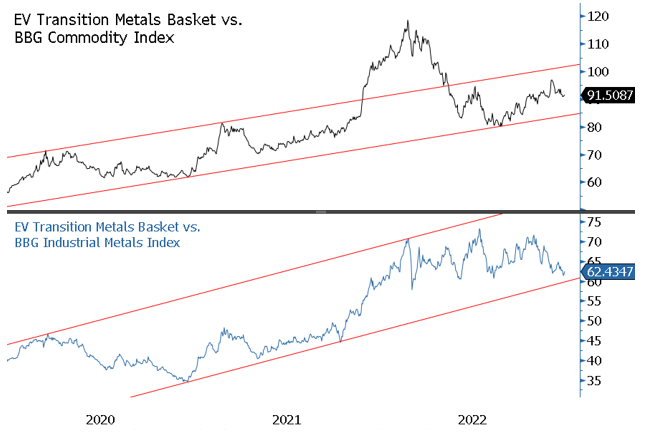

In Figure 4a, we created an unweighted basket of seven transition energy metals used in an EV battery. We compared this EV metals basket to the Bloomberg Commodity Index (a broad commodity index) and the Bloomberg Industrial Metals Subindex (base metals). Since 2020, the basket of battery metals has been in a steady outperformance trend relative to both the broad commodity and base metals indices.

Figure 4a. EV Transition Metals versus Bloomberg Commodity and Industrial Metals Indices (2020-2022)

Source: Bloomberg. Data as of 12/31/2022. Included for illustrative purposes only. Past performance is no guarantee of future results.

Part C: The Important Role of Precious Metals

2022 Year in Review

Gold closed 2022 down $5.18 per ounce or -0.28%, to close at $1,824.02. For the year, the spot gold average was $1,802.46 versus an average of $1,798.85 for 2021 (up $3.61 per ounce). Gold began the year surging to a closing high of $2,050.76 by late February as Russia invaded Ukraine, sparking fears of a broader military conflict involving nuclear superpowers. Within weeks, the war had reached a military stalemate, and gold began to drift lower, driven by a new concern: a very hawkish Fed caught offside by surprising soaring inflation. A series of much-higher-than-expected inflation reports sparked four consecutive 75 basis point rate hikes, pressuring gold and virtually all risk assets.

2022 saw the most aggressive interest rate hikes in over 40 years, compressing valuation multiples and long-duration assets. Due to the lag effects of monetary policy, we believe that 2023 is when economic and financial system risks are likely to emerge. Gold historically performs poorly with rising interest rates but does better in risk-off environments as a safe-haven asset. Gold sold off during the aggressive rate hike portion as CTA-type funds13 reduced longs and heavily shorted gold. With the Federal Reserve (“Fed”) announcing the end of outsized rate hikes and better-than-expected inflation data (CPI, consumer price index), gold, by yearend, had recovered from its summer price swoon.

Comments

Post a Comment