#5. Copper: Structural Supply Deficit and Demand Shock

#5. Copper: Structural Supply Deficit and Demand Shock

Copper is one of the most vital metals powering the global energy transition, especially given that it is essential for electricity generation and transmission. Copper is critical for wind, solar, hydroelectric and thermal renewable energy and electric vehicles, and the amount required as demand for electricity increases is potentially immense. Renewable energy systems require 5-7x the amount of copper versus traditional designs, and electric vehicles (EVs) require 3x the amount of copper compared to gasoline-powered cars.

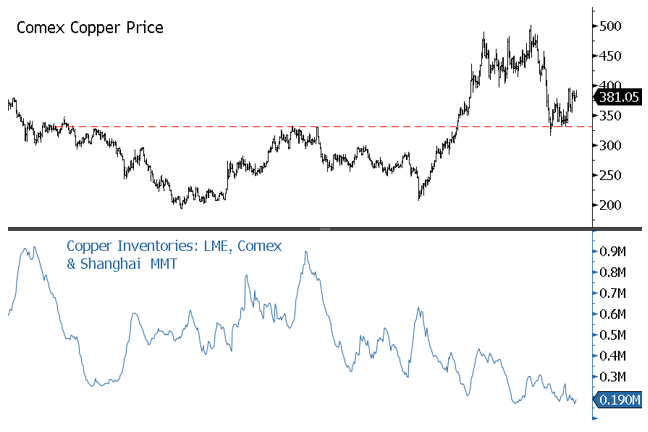

Inventory levels for copper (and all industrial metals) are critically low (see Figure 2). Over a decade of underinvestment followed by COVID-induced restrictions and supply chain issues hampered supply growth leading to structural supply shortages with the tightest supply-demand balance in decades. The surprisingly post-COVID solid global recovery in demand has put copper in a deficit situation, requiring draws on inventories to balance supply and demand.

In times of low inventories, physical deliverable contracts for copper are highly susceptible to price volatility from financial markets. The risk of a global recession, continuing growth struggles in China and typical Q1 seasonal weakness could produce near-term price weakness in copper. But into Q2 seasonal buying strength, a price squeeze higher is likely as physical deliveries (with low inventories) are required into expiry. Insufficient stock and inventory cover will likely prevent sustained copper price weakness, and the demand from the energy transition argues for higher long-term copper prices.

Figure 2. Copper Price and Chronic Low Copper Inventories (2013-2022)

Source: Bloomberg. Data as of 12/31/2022. Included for illustrative purposes only. Past performance is no guarantee of future results.

Copper is used in home, cars, electric vehicle and for transition of electricity so will be in demand.

Comments

Post a Comment